Best Trading Platforms & Online Brokers of April 2024

Use our interactive broker finder for the best broker that caters your needs.

- An extensive research was conducted

- Trading platforms' features are transparently displayed

- Have a look at brokers that are rated for good customer support

Fully Regulated

Expertly Reviewed

Secure & Trusted

Low Fees

Strong mobile capabilities

Online brokers are your gateway to online investments. Every brokerage account comes with different investment tools. These tools assist investors in building a portfolio based on their needs.

Research tools for analyzing different stocks and educational resources are some of the services provided by the broker.

The majority of the best brokers offer zero to low fees on equities and ETF trades. Therefore, customer support and a strong mobile trading platform are major factors when choosing an online broker.

The best trading platforms must provide fast executions, access to multiple markets, and features that help investors evaluate their market exposure and risk.

Choosing the best online broker can be complicated and time-consuming. We analyzed and compared multiple brokerage firms and their strongest features to help you make an informed decision.

Due to rising interest in cryptocurrencies and the fact regulatory frameworks are in the process, we also factor crypto exposure into our rankings for the brokers.

Our editors have years of trading experience combined and carried an extensive research to provide the best brokerage accounts.

6

Payment methods

Features

Customer service

Classification

Mobile App

Fixed commissions per operation

Account Fee

- Over 2800 CFD instruments are available

- Trade with leverage up to 1:30 for retail accounts

- Plus500 offers a seamless mobile app for trading on the go

81% of retail investor accounts lose money when trading CFDs with this provider.

Account Info

Fees per operation

- Buy shares and ETFs with 0% commission

- Social and copy trading network

- Invest and trade crypto with low fees

76% of retail investor accounts lose money when trading CFDs with this provider.

Account Info

Fees per operation

- Zero commission stocks

- ETFs and crypto

- Excellent mobile trading app

Account Info

Fees per operation

- Offers low-commission CFD and Forex trading

- Exposure to 78 different stock markets

- No minimum deposit required

The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed income can be substantial.

Account Info

Fees per operation

- Great selection of long-term investment products

- Access US-listed stocks

- ETFs

Investing involves risk, including risk of loss.

Account Info

Fees per operation

- Amazing research tools

- Almost no fees

- User-friendly platform

Schwab Stock Slices is not intended to be investment advice or a recommendation of any stock. Investing in stocks can be volatile and involves risk, including loss of principal. Consider your individual circumstances prior to investing.

Account Info

Fees per operation

12 Best Online Brokers and Stock Trading Platforms in 2024

- Plus500 – Best online trading account for CFD trading. Plus500 offers over 2800 financial instruments as well as market-leading charting tools. The broker is suitable for active traders who are looking to place short-term positions.

- eToro: Best stock broker for social trading and long-term investing. eToro offers a selection of Smart Portfolios that are convenient for investors who want to diversify their holdings. eToro also facilitates copy trading and provides all users with a demo account.

- Robinhood: Top stock broker app for beginners. It is possible to invest in US stocks from $1 on a commission-free basis. Robinhood is available on both mobile and desktop, making it possible to manage your portfolio on the go.

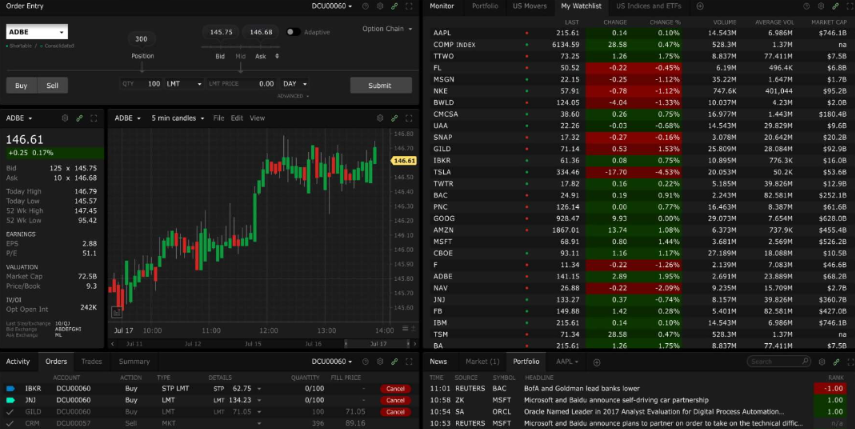

- Interactive Brokers IBKR: Best multi-assets broker for advanced traders. IBKR is suitable for professional traders who are looking to trade with complex strategies. The platform connects users with innovative trading technology and global markets.

- Fidelity: Best broker for commissions-free stock trading and long-term investing. Fidelity offers traditional stock investing as well as ISAs and retirement accounts.

- Charles Schwab: Best broker for mobile-first investing. Charles Schwab is a reputable brokerage firm with a long history. Users can access professional support from advisors.

- Webull: Best online trading platform for advanced charting tools. Webull offers CFD stock trading and is compatible with MT5 for active trading. Users can access a range of tools for research and analysis.

- Saxo Bank: Best forex broker with a strong industry reputation. There are over 190 different FX pairs available on the platform and a total of 7000 tradeable symbols.

- SoFi Invest: Best online brokerage for long-term investments. SoFi offers traditional investment accounts as well as retirement accounts. The broker is an all-in-one platform with beginner-friendly features.

- Plynk: User-friendly investment app and winner of Benzinga’s Best Brokerage for Beginners 2023. Plynk has a user-friendly interface and excellent educational resources.

- ETrade: Reputable stock broker with 0% commissions. Users can access a range of investment portfolios including managed portfolios and small business accounts to suit their investment needs.

- JP Morgan: Established brokerage firm that offers general investing and retirement accounts. Users can access 0% commission online trades as well as an easy app to manage your portfolio on the go.

There is no guarantee that you will make money with this provider. Proceed at your own risk..

What Is An Online Brokerage Account?

An online brokerage account is a type of financial account that allows individuals to buy and sell assets, such as stocks, bonds, and mutual funds, through a virtual platform. These accounts allow investors to manage their portfolios from the comfort of their homes, providing around-the-clock access to their assets.

In the US, online brokerages must comply with regulations outlined by the SEC and are monitored to maintain customer safety and security. Some platforms are also regulated by external jurisdictions, meaning that they must comply with standards set by countries around the globe. Stringent regulations mean that online brokers are safe to use in the US, as long as you take the recommended risk management precautions.

As well as providing platforms for executing trades, online brokers often offer educational resources and analysis tools. These can be used by traders to improve thier knowledge and make informed trading decisions. Some even offer paper trading accounts, allowing users to practice trading without risking real money.

However, it’s important to consider that each online broker is unique and may not be suitable for all investors. It’s crucial to thoroughly compare various platforms before choosing one that aligns with your investment goals and financial situation.

What Brokerage Account is Best?

The best brokerage account comes down to your individual goals, experience, and available funds. We have picked out 12 top-rated platforms that are considered to be amongst the best options. However, not all of the platforms in this guide will be suitable for you.

If you are looking to start with a low deposit, the best broker is Robinhood, which has a $0 initial deposit requirement. Furthermore, the broker allows you to invest from just $1 which makes it an attractive option for investors who want to build a portfolio with a small amount of funds.

On the other hand, if you are interested in social or copy trading, we recommend eToro as a good platform to consider. eToro provides industry-leading social trading features that allow users to connect with others and copy the strategies of professional traders. eToro also has a fairly low account minimum of $20 for individual stock trading as well as a free paper trading account.

For traders who have more capital and want to explore active trading strategies, Plus500 is a top-rated option. Plsu500 is an online CFD broker that facilitates day trading strategies. The platforms come equipped with advanced charting tools for technical analysis as well as tight spreads and fast execution speeds.

How Much Money Do I Need To Start Trading?

It is possible to start trading with as little as $1 in the US. To do this, you will need to choose a platform that has low minimum deposit requirements and supports fractional investing. This involves buying a percentage of a stock rather than investing in the whole asset.

It is also important to look for a platform that has low trading and account management fees. Broker fees can quickly increase the costs of trading, especially if the broker charges fees for withdrawals or inactivity. Most reputable online brokers will provide a transparent overview of their fees on their website. It is a good idea to familiarize yourself with a platform’s fee structure before creating an account.

Best Brokerage Accounts for Online Trading Compared

In the following section, we will take a closer look at 6 of the best brokers and trading platforms that we have selected for 2024. We will explain what each broker offers as well as what type of trading they are best suited for.

1. Plus500 – The best online CFD trading platform

Plus500 offers over 2800 CFD assets to trade. From forex and cryptocurrencies to stocks and commodities, Plus500 provides an extensive selection of instruments to diversify your trading strategy. This variety allows traders to take advantage of different market movements.

Furthermore, Plus500 stands out due to its advanced trading tools and features which include it’s own proprietary charting interface. The platform provides real-time market data, live charts, and customizable indicators that help active traders make informed decisions. In addition, Plus500 offers risk management tools such as stop-loss orders and price alerts, allowing users to protect their investments and manage potential losses effectively.

It’s important to note that Plus500 is also regulated by reputable authorities, such as the Financial Conduct Authority (FCA) in the UK. This ensures that the platform operates with transparency and adheres to strict regulatory standards, providing users with a secure and reliable trading environment.

Pros:

- Over 2800 CFD instruments are available

- Available on mobile and desktop devices

- Trade with leverage up to 1:30

- 0% commissions on stock CFDs

- Professional accounts available to clients with a portfolio of over $500,000

- Plus500 offers a free demo trading account

Cons:

- Assets are limited to CFDs

- No social trading features are available

- Plus500 is not compatible with any third-party charting tools

There is no guarantee that you will make money with this provider. Proceed at your own risk..

2. eToro - Leading social trading platform

eToro is continuing to expand at a rapid pace. The broker that started with less than 150 stocks currently offers 3,000 different stocks to invest in. Advanced social trading tools into the trading platform, enhancing the overall experience. Investors also have access to over 65 smart portfolios, focusing on different investment sectors.

eToro is our choice for the best social trading broker. According to Statista, over 30 million traders are using the eToro investment platform. Since 2016, eToro has more than tripled its clients, demonstrating strong growth. Social trading is among the strongest features eToro offers to online traders in over 130 countries. According to Deloitte, the key benefit of social investing is transparency.

eToro offers excellent customer service and powerful mobile trading apps. Options trading takes place in a separate app. While some find it less convenient that not all trading capabilities are available in a single app, the overall capabilities of the platform and user experience compensate.

The broker is offering zero commissions for stock trades. Although it may be subject to change, eToro covers the SEC and FINRA fees when trading stocks. As a result, buying stocks with eToro makes it one of the top choices for social trading.

Pros:

- Seamless social trading experience

- Fractional shares trading in over 3,000 stocks and ETFs

- Access to a wide range of cryptocurrencies

- Over +65 smart portfolios to track

Cons:

- USD is the only base currency

- Margin trading is restricted to options

- Minimum balance for copying smart portfolios

- Minimum account opening varies from country to country

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

3. Robinhood - Best brokerage app for fractional investing

Robinhood investment platform provides commission-free trading in stocks, ETFs, cryptocurrencies, and low fees on options compared to its competitors. According to WSJ, the average age of investors on the online brokerage platform is 31. indicating it is favored by young investors, some of whom are new to online investments.

Robinhood gained immense popularity during the infamous GameStop stock rally. Social media platform Reddit triggered and fueled the rally, short-squeezing a hedge fund that shorted the stock.

Robinhood web platform and mobile trading app interface are user-friendly. The process of creating a brokerage account is fairly straightforward from either desktops or smartphones. Furthermore, the minimum trade size at Robinhood is just $1 which makes the platform ideal for fractional investing.

The streamlined platform, the broker's focus on young investors, and commission-free trading place Robinhood as one of the best brokers for beginners.

Besides traditional investing accounts, the online broker has a spending account. As the name suggests, a Robinhood spending account is intended for spending activities such as groceries, paying bills, and requesting money from friends, etc. All spending account holders receive a Robinhood Cash card issued by Sutton Bank. Using the Robinhood Cash card comes with great benefits.

Round-ups are applied to all transactions (up to $100 a week) where collected capital can be used for investing in stocks or ETFs automatically.

Pros:

- $0 commissions for trading crypto

- Fractional shares trading

- Over +5,000 securities

- 24-hour market on selected stocks including Amazon, Tesla, and Apple

- +5% APY on uninvested brokerage cash for Gold customers

Cons:

- No mutual funds or bonds

- Investment research tools are reserved for Gold members for $5 a month

- +5% APY requires a Gold subscription

- No paper trading

- Limited customer support

There is no guarantee that you will make money with this provider. Proceed at your own risk..

4. Interactive Brokers - Best multi-assets broker

Interactive Brokers (IBKR) offers a broad range of investment products that are often not seen in traditional brokers. Investors and traders have access to multiple securities via the brokerage account to global stocks (U.S, Europe, and Asia-Pacific), options, futures, spot currencies, US spot gold, bonds, stock ETFs, mutual funds, single stock futures (SSFs), warrants, hedge fund marketplace (for eligible customers) and more.

IBKR is among the stock brokers that offer overnight trading, powered by Blue Ocean ATS. A broad range of assets including block orders. A spectrum of Individual retirement accounts (IRAs) are available on IBKR that suit all.

Interactive Brokers are also famed for algorithmic trading. Investors and traders alike can develop automated trading strategies for their preferred financial assets. IBKR supports C++, C#, Java, Python, ActiveX, RTD or DDE. For investors who are unfamiliar with coding, the broker offers access to capitalise.ai at no additional costs, allowing them to convert standard English text into fully automated strategies.

An example of the above is an automated instruction that increases the trade size on predetermined time intervals. It is often executed to spread a large investment into smaller trades.

IBKR offers access to more than 150 markets in 33 countries. Investors that seek access to multiple international markets including Mexico, Argentina, and Canada at low transaction costs, IBKR may cater to your needs.

Multiple base currencies are available for the investment account such as USD, AUD, NZD, SGD, CZK, HUF, and many others.

While many U.S. brokerage services focus solely on U.S. investors, IBKR provides similar conditions to Latin American residents via a partnership with American Express (excluding Puerto Rico and the U.S. Virgin Islands).

Pros:

- Over 1,000,000 municipal securities

- Fractional shares trading

- Improved educational resources

- +7,884 credit default swaps (CDS)

- Overnight trading services for more than +10,000 stocks and ETFs

Cons:

- IBKR trading platform's interface can be overwhelming for new investors

- Complex fees structure

- Limited range of cryptocurrencies

There is no guarantee that you will make money with this provider. Proceed at your own risk..

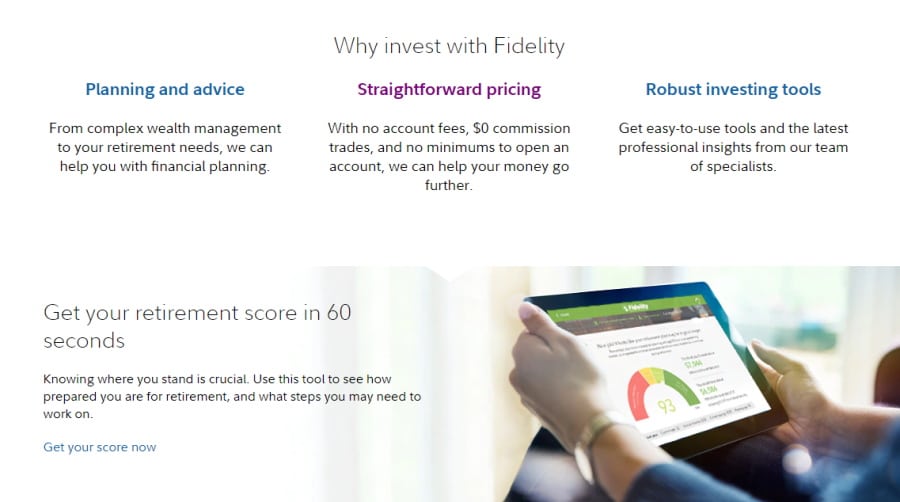

5. Fidelity - Robust trading platform for commissions-free investing

Fidelity brokerage firm offers $0 account opening, $0 commissions on U.S stocks and ETFs, and zero advisory fees for the robo advisor for investments below $25,000. Although many brokers offer $0 commissions for trading U.S. stocks, Fidelity offers withdrawals with $0 commissions, which is a big plus.

Fidelity, a multi-national financial services corporation was established in 1946 and serves over 40 million individual investors at the time of this writing. To remain competitive in the digital era, Fidelity released 7 iOS apps (including Apple Watch support) and 5 apps for Android-based devices.

Fidelity is famed for its low-cost brokerage services. Furthermore, the customer service is outstanding, which contributes to the millions of investors that are using the trading platforms.

It is possible to access a range of different investment types through Fidelity. These include traditional investment accounts as well as retirement accounts, savings accounts, and child investing accounts. The brokerage account provides you with access to 25 international markets (an international trading agreement is required).

For crypto exposure, Fidelity Crypto offers trading in Bitcoin and Ethereum, the most popular cryptocurrencies as of today. Fidelity Investments is among the US brokers that applied for spot Ether ETF on Nov 17, 2023.

The Fidelity trading platform is rich with features. We liked that you can create and save up to 50 orders that can be executed with a click of a button.

Pros:

- A broad number of investment services

- Fractional shares trading

- Supports conditional orders

- Short selling is available

- Access to 25 markets

Cons:

- Users reported that Fidelity Active Trader Pro can be slow

- Limited range of cryptocurrencies

There is no guarantee that you will make money with this provider. Proceed at your own risk..

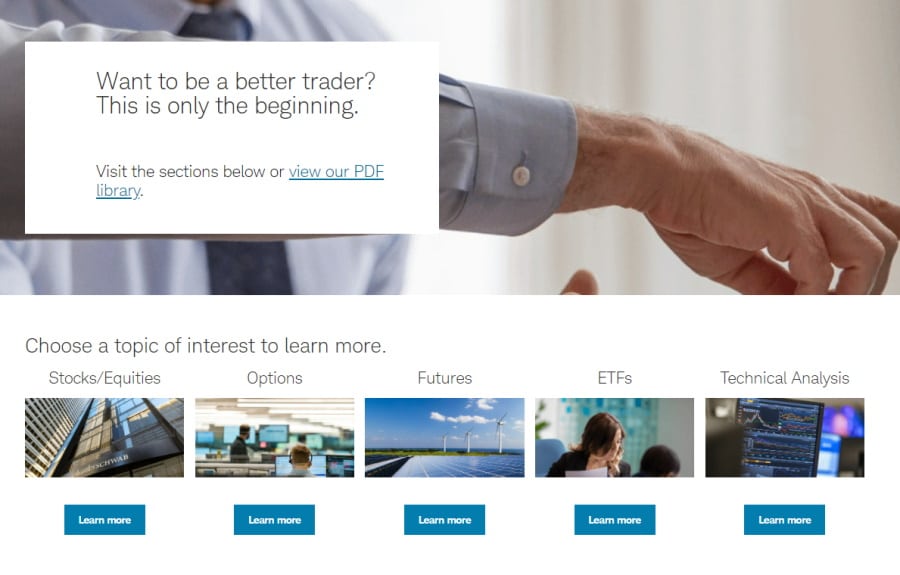

7. Charles Schwab - Reputable US brokerage with excellent educational resources

Charles Schwab offers 24/7 customer support through phone, email, and live chat. Customers can also access a robust investing app and receive high-end investment research from Morningstar and Argus.

Charles Schwab has been providing financial services since 1971. As of July 2023, the firm has 34,4 million active brokerage accounts and 2.4 million retirement plan participants.

Charles Schwab & Co, Inc. (which offers brokerage products) and Charles Schwab Bank SSB are subsidiaries of Charles Schwab Corporation.

The investment app comes with an intelligent assistant that takes orders via voice commands. Some of the trading commands that can be initiated by voice only are placing trades, receiving quotes, setting alerts, transferring assets, and answering investment questions.

The technology and the strong back of the trading platform place Charles Schwab as the best broker for mobile-first investing. Charles Schwab's mobile investing app comes with many features. The trading voice commands is a feature we particularly like. While many traditional stock traders aren't likely to rush to innovative tech, we are expecting voice commands' popularity to increase with time.

Moreover, Charles Schwab is known for providing some of the best educational resources in the trading space. The broker provides a number of financial planning resources, in-depth guides, wealth management information and the Schwab Wealth Advisory system which offers personalized advice to investors.

Pros:

- Customer support is available 24/7

- Fractional shares trading

- around $7.65 trillion in client assets

- Among the biggest discount brokers in the United States

- Robo advisor services

Cons:

- No crypto exposure (only via cryptocurrency coin trusts)

- $5,000 minimum investment for robo-advisor services

- Automated tax-loss harvesting requires a minimum of $50k in investible assets

- Currencies and futures trading is available in a dedicated platform (thinkorswim)

There is no guarantee that you will make money with this provider. Proceed at your own risk..

How We Picked The Best Online Brokers and Trading Platforms

Our team of experts spent time researching different online brokers to find the best options for US investors in2024. Here’s what we looked for during the process.

- Low fees: First and foremost, we looked for platforms that offer low trading and non-trading fees to cater to investors who are looking to start with a small amount of funds. Most of the brokers that made it to the top 6 offer 0% commissions on US stocks, low spreads and free withdrawals and deposits. When choosing an online trading platform, it is important to thoroughly research the fee structure so that you don’t get caught out by hidden fees.

- Ease of use: The best brokers should have a user-friendly interface that is easy to navigate. This makes the process of conducting analysis and placing trades accessible to all traders, no matter their experience. The availability of a mobile app also contributes to the ease of use. Brokers that offer mobile apps are appealing because they allow investors to manage their portfolio’s on the go.

- Regulation: We looked for USA brokerages that are regulated by global financial bodies. The trading platforms that made are list are regulated by some of the top regulators including the UK’s Financial Conduct Authority, CySEC, ASIC, FINRA, and the SEC.

- Asset availability: To support a diverse trading and investing strategy, online brokers must offer a range of financial instruments. Many of the brokers that we have selected offer a mixture of traditional stocks, ETFs, commodities, indices, cryptocurrencies, and CFDs. Some of the best brokers also offer ready-made portfolios that provide exposure to a basket of different assets.

Can You Buy Stocks Without a Broker?

Investing in the stock market used to be a daunting task that required a broker to execute trades on your behalf. However, the digital world has made it easier to buy stocks without the help of a middleman.

One way to buy stocks without a broker in the US is to buy directly from the company, also known as a direct stock purchase plan. To do this, you will need to thoroughly research the company and understand the protocols for buying stock from them. This usually requires prior knowledge of the stock markets and is not recommended for complete beginners.

The main advantage of a direct stock purchase plan is that you can avoid brokerage fees. However, the process of executing an order can be more time-consuming and it may be more difficult to manage your portfolio.

Best Brokerage Accounts Summary

In this guide, we have reviewed the 6 best online brokers for 2024 to understand what they offer and why they are good options for US investors. The best online brokerage accounts are Plus500, eToro, and Robinhood. Each of these platforms is user-friendly, offers 0% commissions on US stocks, and provides all users with a free demo account that can be used to test the platform before putting any real money at risk.

The information provided in this guide is based on the research and experiences of our team. However, it is important to understand that your own experiences with each broker may differ. Therefore, it is important to conduct your own research before making any final decisions. Investing with an online broker comes with risk.

When researching different brokerage platforms, look for providers that are regulated, offer a variety of assets, have a low fee structure, and provide a range of educational resources. Understanding what to look for in an online broker can help you to make an informed decision.

Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

FAQs

How much do I need to start trading?

Do all brokers have a mobile trading platform?

Is investing in crypto the same as stocks?

How much does it cost to trade online?

What is the top trading platform in the US?

What are the best stock brokers?

Find The Best Broker For You

Best UK Stock, Forex, CFD, Crypto, Social or Day Trading Platform that meets your needs.